Forty Seven is a unique project built to

create a modern universal bank both for users of cryptocurrencies and

adherents of the traditional monetary system; a bank that will be

acknowledged by international financial organisations; a bank that will

correspond to all the requirements of regulators.

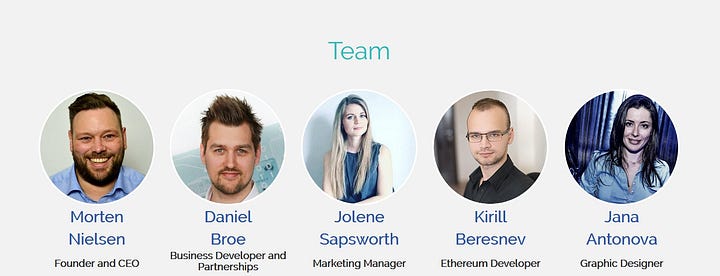

A team of professionals from the worlds of

banking, finance, and IT with expertise and experience in the creation

and licensing of payment systems, and building of electronic financial

institutions will work to realise the goals of the project.

Our bank will become the biggest structure

that corresponds to all the requirements of regulators and the EU

Payment Services Directive 2 (PSD2). We will comply with Know Your

Customer (KYC) and Anti-Money Laundering (AML) policies in order to

guard against agents of the “grey” market.

Forty Seven is based on three principles:

relevance, convenience, and security. Our specialists use up-to-date

technological developments such as blockchain, biometrics, smart

contracts, machine learning and many others. If you are interested in

the specific details of our establishment and creation of a hi-tech

bank.

Forty Seven Mission

The

mission of Forty Seven Bank and management team is to provide safe,

innovative and user-friendly financial services and products to our

customers – individuals, businesses, developers, traders, financial and

governmental institutions.

Forty

Seven Bank is a bridge capable of connecting two financial worlds and

establishing efficient communication between them, a communication that

will open up possibilities to level up the whole modern financial

system.

Forty Seven Vision

Forty

seven believe that after PSD2 directive comes into force in the

beginning of 2018, the future of EU financial sector will change

significantly. Forty Seven Bank system will be developed in accordance

to upcoming regulatory framework from the early stages – it will give

Forty Seven Bank competitive advantage in terms of time and costs. This

is a significantly beneficial aspect prior to the traditional banking

which has to impose reorganisational procedures in order to meet new

standards.

The

big portion of financial sector market share will be shifted to

financial technology start-ups that will be able to oer and provide

unique products and services together with high-quality customer and

technological support. We aregoing to take the leading position among

these start-ups and become one ofthe pioneers in the changing financial

world.

Our Value

1. Transparency

2. Financial stability

3. Effectiveness and user firendly procedures

4. Security and privacy (data protection)

5. Innovativeness

6. Customer satisfaction

7. Market share growth and worldwide expansion

8. Profit for all stakeholders

Forty Seven Is Innovative products for everyone

The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorisation based on passport and biometric data

- Unique combination of payment tools – SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions

with any type of cryptocurrency through the bank’s application and with

no need to wait for current exchanges. Uploading, withdrawal, and

conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis

that helps a client to make the right financial decisions via services

of a personal manager created on the basis of machine learning

algorithms

Forty Seven is Propositions for business

Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving

payments from a merchant in both cryptocurrencies and in fiat money on

the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring

services based on the operation of machine learning and big data

(artificially intelligent algorithms able to predict the probability of

repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions

Tools and services for external developers

- Opportunity to provide Forty Seven banking services under your own brand (white label)

- API

access that allows the development and implementation of modern

financial services based on Forty Seven infrastructure and processes

- Holding DevDays conferences for independent developers

- A showcase of financial applications using Forty Seven API

Products for Private Persons

Account Management : Forty Seven Bank clients will have a lot of possibilities

related to account management. Having access to just one application, a

customer will have access to all his accounts in dierent banks at one

place it will be easy to manage personal finance in such a way. Besides

that, a client is going

to have access to all his crypto wallets, investments in traditional

financial assets (stocks, bonds, commodities, etc.) and credit or debit

cards. This is a featured product oered by the bank and it is called a

“Multi Asset Account”. The product will reduce complexities of using

dierent types of assets by centralising all the financial activities of

our private customers at our single system. It will be easy to quickly

transfer resources from one fiat currency to another, or from fiat

currency to a digital currency, or vice versa. Moreover, transaction

costs will be reduced substantially by doing that at Forty Seven Bank.

Our App Platform will also allow clients to use several analytical

applications that might help in personal finance management.

Invoicing : Forty

Seven Bank will support its customers who are oering small products and

services as individuals without having a company. Such individuals

might be freelancers, copywriters, developers, translators, handcraft

professionals, etc. The bank will provide user friendly and simple

invoicing services for such customers. By using the service, a client

will be able to automatically issue invoices and receive both fiat and

nonfiat funds to cover them.

Deposits and Loans : The bank will oer deposits and loans in traditional

fiat currencies like EUR, USD and others, as well as in non-fiat

digital currencies like BTC, ETH and others. At the moment, there is no

financial institution

in the world that is oering similar products in non-fiat digital

assets, whereas we see that there is huge potential in developing and introducing classic banking products for non-fiat digital currencies.

Investments and Brokerage : Individual

clients will have opportunities to create and manage their investment

portfolio by using investment and brokerage services provided by Forty

Seven Bank. The bank is going to develop its own exchange in addition to

partnering exchanges that could be connected to by using Forty Seven

Bank platform via API.

Other Services : The bank will also oer traditional products and services

like insurance, payments and transfers, payment history and analysis,

cash withdrawals at Forty Seven Bank Smart ATMs, as well as at ATMs

of our partnering banks. Additionally, Forty Seven Bank will provide

smart support with integrated machine learning technologies to our individual customers — it will help to resolve issues between the bank and its customers in evective way.

Features and technologies

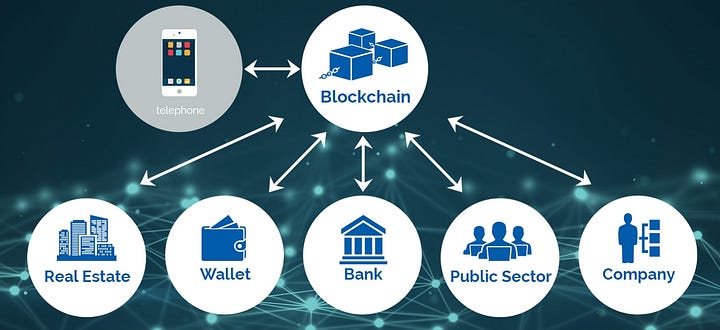

Based

on the possibilities of the banking and cryptocurrency industries, we

will take the best of the two spheres using innovative and proven

technologies in the fields of finance, analytics, and data security.

Forty

Seven Bank will provide open, flexible and well-documented API covering

the majority of banking services. We will launch our own financial

application platform that uses our API. By attracting clients and

external developers, we plan to turn it into an efficient ecosystem with

constantly growing value.

Application

of smart contracts to automate financial processes, thereby enabling us

to make deals and give credits with no risk of fraud. The

implementation of machine learning technology will allow the creation of

a personal manager to foresee all wishes of the client. A virtual

interlocutor will assist in the reallocation of cash flows and will

provide timely current financial information.

Biometric

technologies and blockchain will enable users to open an account

distantly and access it via smartphone and ATM without using a card. In

combination with cryptographic encryption, these developments will

provide increased security of personal and payment data.

Forty Seven Token

What is a Forty Seven Token:

It’s

a token that represents a part in Forty Seven Bank’s infrastructure and

grants the wielder a priority place in the bank’s loyalty program.

Holders of FSBT tokens have the right to receive yearly bonuses in the

form of FSBL — Forty Seven Bank loyalty tokens. Besides that, FSBT

tokens are a crucial economic part of Forty Seven Bank’s

ecosystem — they will be needed in order to access the full range of

products and services. After the crowdfunding campaign is finished, FSBT

tokens will be available for trade at various cryptocurrency exchanges.

What is a token used for:

20%

of the bank’s annual net profit will be invested into the loyalty

program. Using smart contracts, each FSBT token holder will be able to

receive their FSBL tokens based on the amount owned and afterward,

exchange the FSBT tokens for different goods offered by the loyalty

program (electronics, household items, airplane tickets, banking

services, insurances, etc.). All FSBT token holders will receive the

right to participate in Forty Seven Bank’s yearly crypto community

development program and decide which projects will be supported by the

bank and its shareholders.

Abbreviation: FSBT.

Control over emission: is provided by the system of interconnected smart contracts.

Rate: Fixed, value of one token — 0.0047 ETH.

Maximum amount of tokens to be generated: 55 319 149 FSBT (incl. bonus tokens, tokens for bounty and founders).

Minimum budget to start the project: 18 000 ETH (5M EUR).

Hardcap: 180 000 ETH (50M EUR).Accepted cryptocurrencies on ICO: ETH, BTC.

ICO round 1: November 16 — December 16, 2017.

ICO round 2, 3: Q1 2018 (TBD).

How To Participate On Forty Seven

2. Complete the registration.

Road Map

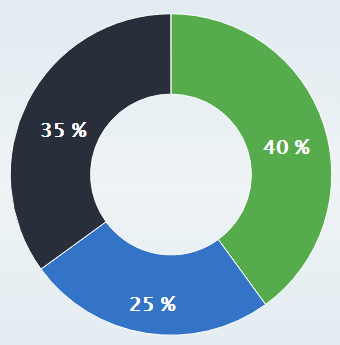

Token Distribution

Forty Seven Listed On

Detail Information :

By.Trinurtrii